Investing in

Businesses

That Change

the World

Future Fund Alpha

Long/Short, LP

THE FUTURE FUND LLC IS LAUNCHING A GROWTH ORIENTED HEDGED EQUITY FUND

A Strategy to Manage Risk In A Volatile Environment

Future Fund Alpha Long/Short, LP capitalizes on deep fundamental research, a high conviction investment style, and years of operating experience to invest in companies best able to exploit secular megatrends and short companies most disrupted by those same megatrends.

Goal - Outperform the S&P 500 with approximately half the risk.

Expertise - Future Fund Co-PMs Gary Black and David Kalis have a combined 50+ years of growth investing experience, have worked together for 10 years, and share a similar high conviction disciplined growth investment philosophy and tolerance toward risk.

Investment Edge - We see what others don't and act with high conviction and valuation discipline, building a concentrated portfolio with an investment horizon of three-to-five years. We target stocks with an Upside/Downside of 2:1.

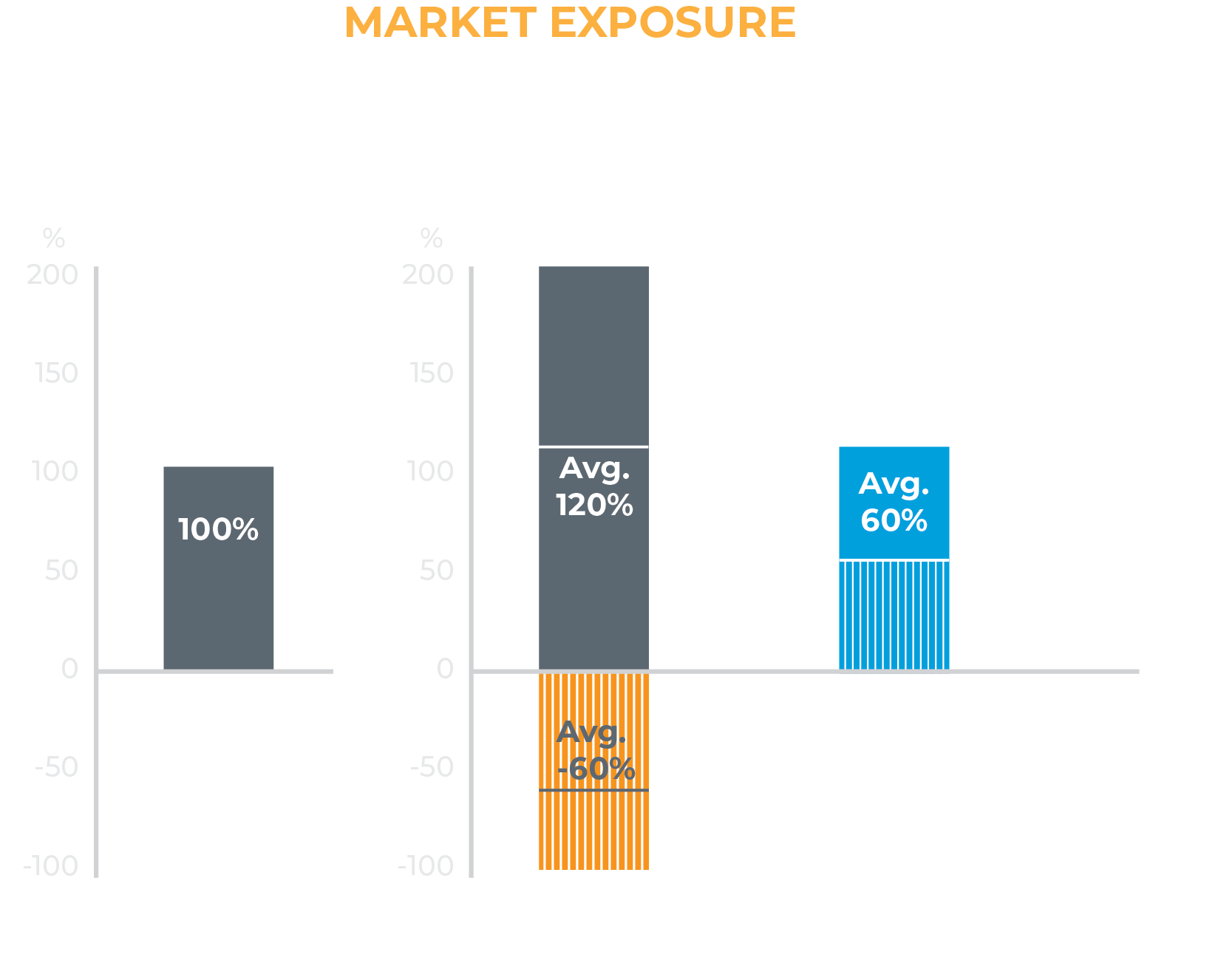

Downside Protection in Volatile Markets - Average target long exposure to the market is 120%, with an average net exposure of 60%, providing investors with downside protection in volatile markets.

Benchmark Agnostic - The portfolio is not indexed to a benchmark, creating a non-correlated return profile.

Market Outlook - We expect the market to remain volatile as higher interest rates slow the growth of the global economy, creating significant opportunities to create alpha for our clients.

The Opportunity

1

Future Fund Alpha Long/Short, LP is a high-conviction risk-managed active strategy being launched by The Future Fund LLC. The Fund provides the >potential to capitalize on the opportunities created by key megatrends driving the economy.

2

These megatrends will produce both winners and losers - transformative companies that will successfully exploit these trends and others that will fail to adapt or are unable to keep up with the leaders.

3

We believe these megatrends have not been fully recognized by investors. The Fund capitalizes on our fundamental research expertise and our deep research into these trends.

4

The Future Fund LLC is an SEC-Registered Investment Advisor managing investment portfolios focusing on companies with secular growth opportunities in the global markets.

THE FUTURE FUND ALPHA LONG/SHORT, LP: WHY NOW?

The Benefits of Allocating to a Long/Short Strategy

Over the past two years, the equity and fixed income markets have incurred increased volatility as inflation has spiked and the Federal Reserve has raised interest rates at an unprecedented pace. This volatility has created an environment where risk management and capital preservation have become paramount.

Allocating a portion of an investor's portfolio to a hedge strategy is attractive to investors for the following reasons:

Active Risk Management through portfolio construction and hedging.

Capital Preservation by adjusting exposure levels during drawdown periods.

Alpha Generation through active stock selection and capitalizing on short-term dislocations in the market with potential to provide greater risk-adjusted returns than the indices.

Lower Correlation to the broader equity market, which may reduce portfolio volatility.

Diversification through capitalizing on multiple megatrends.

characteristics of long and short positions

Selecting Longs or Shorts Requires Intense Research, Analytical Rigor, Conviction, and a Long-term Investment Horizon

Longs

Companies that can transform an industry with a first mover advantage(s), with a superior management team.

Companies with product superiority that can sell into large markets.

Stocks that the market misunderstands or are surrounded with investment controversy.

Shorts

Companies with flawed business models facing structural and secular challenges:

- Companies that we believe may attempt - but ultimately fail - to capitalize on a thematic secular trend.

- Legacy incumbents that have not adapted and that we expect will be negatively affected by these strong trends.

Stocks of companies discounting unsustainable levels of profitability or growth.

Businesses where negative competitive dynamics are not understood and priced into the stock.

Investment Philosophy

Our Goal: Superior risk-adjusted performance over the full market cycle

We believe transformative companies will displace legacy industry incumbents in several key sectors, building strong brand recognition and first-mover advantages, while increasing market share.

The threat to existing businesses is high and the long-term opportunities for companies and investors participating in this change will lead to significant value creation.

Investment Approach

We identify transformative companies affected by significant secular trends over 3-5 years that create long-term value (long positions) and companies that are at a strategic disadvantage in their markets (short positions).

Focused on leading secular growth opportunities

Secular Growth Idea Generation

We seek to identify inflection points in multiyear secular trends driven by changes in technology, consumer preferences, demographics, and environmental sustainability, which can lead to significant increases in their markets, earnings trajectories, and market capitalizations.

Key Secular Megatrends

Terms of the Offering

$50,000,000

$20,000,000 Founders Class Limited Partnership Units

$30,000,000 Class A Limited Partnership Units

The Fund is offering a maximum of $50,000,000 (up to $20,000,000 Founders Class and up to $30,000,000 Class A) Limited Partnership Interests at a price of $10 per Unit. Upon completion of the Offering, up to 2,000,000 Founders Class and up to 3,000,000 Class A Limited Partnership Interests will be issued.

The General Partner may make distributions to the Limited Partners from time to time, in such aggregate amounts and at such times as determined by the General Partner in its sole discretion. Any such distributions shall be made to the Limited Partners in accordance with their Capital Accounts as of the record date of the distribution. Except as provided pursuant to the foregoing provisions and other detailed statements of the Limited Partnership Agreement, such as Withdrawals or Dissolution, no Partner shall be entitled to receive distributions from the Partnership.

Management Team

The Company is currently managed by seasoned business and sector professionals dedicated to the success of the Company and efficient execution of its planned operations.

Gary Black

Managing Partner, The Future Fund LLC

Gary Black

Gary Black is the managing partner and co-founder of The Future Fund LLC, an SEC registered investment advisor focused on investing in growth equities of companies that are changing the world. Gary has extensive experience spanning nearly 30 years in top management positions at some of the most well-respected global investment management firms.

As CEO of Aegon Asset Management, he oversaw $120 billion in assets, representing a third of Aegon´s assets and 50 percent of its profits. During his tenure, he created new proprietary investment strategies, expanded the real assets platform, leveraged the company´s solutions-based offerings, and directed the build-out of an ESG fixed income platform.

In 2009, Gary launched and managed Black Capital, a top-performing fundamental-based global long/short equity firm with an eight-person investment team, raising $100 million AUM over three years. The firm was acquired by Calamos Investments in 2012, where Gary became Global Co-Chief Investment Officer. There, he launched two additional two long/short equity strategies and served on the Calamos Board of Directors.

At Janus Capital Group, Gary was promoted to CEO, CIO and president after turning around investment performance and growing net flows to +$2 billion in 2008 from -$29 billion in 2004 after the tech bubble burst, market timing changes and the departure of Janus founder and CEO. Under his guidance, the Janus Research Fund and Janus Triton Fund were launched. He also served on the Janus Board of Directors.

Earlier in his career, he was named CIO at Goldman Sachs for the U.S. Asset Management Group and named to the firm´s Partnership Committee. His investment industry experience began at Sanford Bernstein in 1992 as Senior Research Analyst. Gary was rated #1 analyst in his sector by Institutional Investor All America Research Team for six consecutive years from 1993-1998, including his first year in the industry. At Bernstein, within five years he was promoted from Senior Research Analyst to Principal and then Shareholder. He later ran the firm's global institutional business. In 2001, Bernstein was acquired by Alliance Capital.

Gary was awarded an M.B.A. from Harvard Business School and earned his B.S. in economics from The Wharton School of the University of Pennsylvania.

Gary has been featured in Barron´s and is frequently called upon by the financial press for his insights into the equity markets.

David P. Kalis, CFA

Partner, The Future Fund LLC

David P. Kalls

David Kalis is the co-founder of The Future Fund LLC, an SEC registered investment advisor focused on investing in growth equities of companies that will be instrumental in changing the world.

In 2017, David founded Curvature Capital Management, LLC, a long/short equity hedge partnership focused on catalyst-driven global equities. Performance for the firm ranked in the top decile of long/short equity hedge funds. In early 2021, he rejoined Gary Black to found The Future Fund. The two had previously worked side-by-side at Calamos Investments.

At Calamos, David headed the Growth Equity Strategies and was a co-portfolio manager. His team managed $6 billion in assets in mutual funds, institutional and separately managed strategies. While there, David restructured several strategies, including changes in philosophy, process, and personnel. As a result, the small-mid cap (SMID) growth strategy ranked in the top decile fund of performance among its peers during David´s tenure as lead manager. As part of his responsibilities, he managed complex relationships between clients, the public company board and the mutual fund board.

An entrepreneur, David founded and managed another long/short hedge fund partnership, Charis Capital Management LLC, focused on SMID-cap equities. This investment strategy was designed to exploit the inefficiencies of the SMID market. His performance ranked in the top decile of equity long/short equity hedge funds. Similarly, during his time at Northern Trust Asset Management (NTAM) in the role of SVP-Group Head of Small/MidCap Institutional Equities, the NTAM active equites mutual fund suite reached the top 10% in its peer group, up from the bottom 10% before he took over. The Mid Cap Growth strategy also achieved top quartile performance.

Earlier in his career, he joined Segall Bryant & Hamill at its founding. He served as a co-manager for both multi-cap and SMID-cap strategies, director of research, and member of the management group. There he was instrumental in developing the firm´s core investment philosophy and process, ushering the firm through a growth phase from $1.2 billion to $5 billion in assets under management. He established and managed the mid cap growth strategy growing it to more than $400 million AUM.

David is a Chartered Financial Analyst, awarded in 1994, and a member of the CFA Society of Chicago. He received a BA in Economics from the University of Michigan.

David has been featured in a wide range of financial publications and is frequently called upon by the press for his expertise.

Advisory Board

Richard

Bindler

Richard Bindler

Richard is the Managing Partner of BMS de-SPAC Opportunity Fund, an $11 million fund applying fundamental research to this badly beaten down and misunderstood universe.

Richard is also the Senior Managing Partner of Bindler Investment Group (BIG), which he founded in 2016. BIG invests in early-stage companies where strategic capital is needed, and opportunistically in real estate. To date, BIG has invested in more than 40 opportunities.

He is an Advisory Board member for Cresset Capital, a $30 billion boutique family office with locations across the United States.

For nearly 30 years, Richard rose through the ranks at Bernstein Private Wealth Management. Here he held positions as a Financial Advisor, Managing Director, Senior Managing Director, and Chief Client Officer where he managed all client-facing personnel nationwide.

Richard is the Chair of the Chicago Advisory Board for Cahn Fellows, a position he has held since 2019. Cahn Fellows helps identify and develop top performing public school principals.

He earned an MBA, specializing in finance and marketing, from Boston University and a BS in business from the University of Florida.

J. Philip

Clark

J. Philip Clark

Phil has spent his entire 45-year career in professional sales and marketing, with the majority of that time in the financial services industry.

Since 2012, he has served as Managing Director for Phoenix Capital Partners, a real estate private equity firm with over $2 billion under management. In 2004, he co-founded Epoch Investment Partners, which grew from $600 million in Assets Under Management to $25 billion when he retired in June of 2012. Fortune magazine named Epoch the 88th Fastest Growing Company in the world in their 2011 report. Epoch was sold in March 2013 to TD Bank for $670 million. Phil led the sales and marketing effort from the very beginning and was instrumental in the firm's rapid growth.

Before founding Epoch, he was a 17-year veteran of Sanford C. Bernstein & Co., now part of Alliance Bernstein. His responsibilities included that of National Managing Director of Bernstein's private client business. Previously, he was Managing Director of Bernstein's Institutional Asset Management business and initiated and managed Bernstein's sub-advisory business.

Prior to Bernstein, Phil spent five years as President of InveQuest Securities, a family-owned investment firm focused on wealthy individuals and seven years in marketing at IBM.

Phil holds a BS in Administrative Sciences from Yale University.

Ross

Gerber

Ross Gerber

Ross is the Co-Founder, President and CEO of Gerber Kawasaki Wealth and Investment Management with $2.2B under management and serving 10,000 clients.

Ross oversees Gerber Kawasaki's corporate and investment management operations as well as serves individual clients. He has become one of the most influential investors on social and in traditional media. His investment ideas and advice have made him a regular in global business news as well on many of the most popular investment podcasts.

The firm is focused on technology, clean energy and transportation, consumer discretionary, media, and entertainment companies. Gerber Kawasaki (GK) is a leader in Fintech innovation leveraging technology and social media. It was listed in 2020 as one of the fastest-growing companies in Los Angeles according to the LABJ.

GK is also a leader in providing investment advice for the younger generation through its Get Invested program. GK is the first major RIA to partner with Gemini and began offering Digital Assets to clients in April 2021. Ross is an expert in online marketing and social media as well as a co-developer of the company's app for IOS, my-moneypage.

In 2008, the financial crisis caused the collapse of several major financial institutions and the government bailout of others, challenging the existing state of affairs within the financial industry. Navigating these trying times, Ross understood the importance of focusing on the client's best interest utilizing a modern and unbiased approach to serving the client community. In 2010, Ross and his business partner, Danilo Kawasaki, felt it was the opportune time to start their firm, Gerber Kawasaki Inc., aligned with this client-centric mission.

Early in his career, Ross joined an independent investment firm affiliated with SunAmerica Securities. In 1998, at the age of 27, he received the Archon and Million Dollar Branch Award and was the youngest million-dollar branch manager in SunAmerica's history.

Ross received his BA in Communications from the Annenberg School at the University of Pennsylvania concentrating in Business Law at the Wharton School of Business, graduating class of 1993. Ross also received a second concentration in Classical Music Studies at the University of Pennsylvania and attended the Grove School of Music.

He is on the executive board and a past president of the Guardians of the Jewish Home in Los Angeles.

Alexandra

Merz

Alexandra Merz

After completing international studies in London and Germany, Alexandra's professional career in Finance began in 1991 in the Parisian trading room of Deutsche Bank. In 1992, she was promoted in 1992 to fund manager, responsible for the money market, bond and equity products.

From 1994 to 1997, she was the key advisor for Commerzbank, managing its two largest European investment funds. She joined Moody's Investor Services in 1998 as Vice President/Senior Credit Officer responsible for all mutual fund ratings in Continental Europe. There she developed a methodology for open-ended real estate fund ratings.

In 2004, Alexandra co-founded and managed Scope OEF GmbH, a firm that specialized in the analysis of open-ended funds, before founding additional companies in the South of France and the USA. In 2014 she established L&F Investor Services in Santa Barbara, California, providing business advice to investors worldwide.

Jeffrey

Yu, MD

Jeffrey Yu, MD

Dr. Jeffrey Yu is an entrepreneur and radiologist. He founded Kineticor, a biometric intelligence and medical device company dedicated to improving the quality of imaging where he still serves as Chief Executive Officer.He is also founder, Chief Medical Officer and past Chief Technology Officer (CTO) of OneMedNet, a medical image transfer software company. During his career, he held the position of CTO of Queen's Medical Center and was a member of the medical advisory boards at Cisco Systems and Change Healthcare.

Jeffrey conducted magnetic resonance research at the Lucas Center Stanford University and is Board Certified in Radiology and Nuclear Medicine. He received his B.S. from the University of California Berkeley and M.D. from Wake Forest School of Medicine, completing a radiology residency and nuclear medicine fellowship at the Mallinckrodt Institute at Washington University.